Dear Linguists,

Thank you for taking the time to read through this document. We have prepared the following guidelines to share knowledge on electronic invoicing in Italy. Please note that these guidelines are not intended to be absolute, and all information in this document should be verified with an accountant or a professional in the field. Therefore, Codex Global will not be held accountable for any misconduct or errors on your part regarding electronic invoicing and the related procedure for Italian taxpayers.

As you may know, electronic invoicing became mandatory for all Italy-based freelancers and companies on January 1, 2024. All taxpayers are now required to issue their invoices on the dedicated section of the INPS website.

Please follow the steps below to prepare your electronic invoices on the INPS website:

- Go to the dedicated section of the INPS portal: https://ivaservizi.agenziaentrate.gov.it/portale/

- Log in with your credentials.

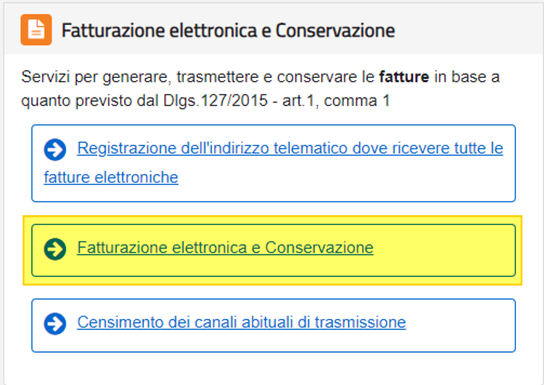

- Navigate to the section called “Fatturazione elettronica e Conservazione” and click the link “Fatturazione elettronica e Conservazione.”

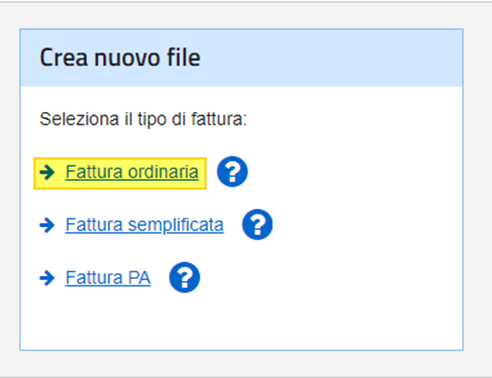

- Click on the type of invoice you need to issue. In this example, we will show you how to prepare a Fattura Ordinaria (“Ordinary Invoice”).

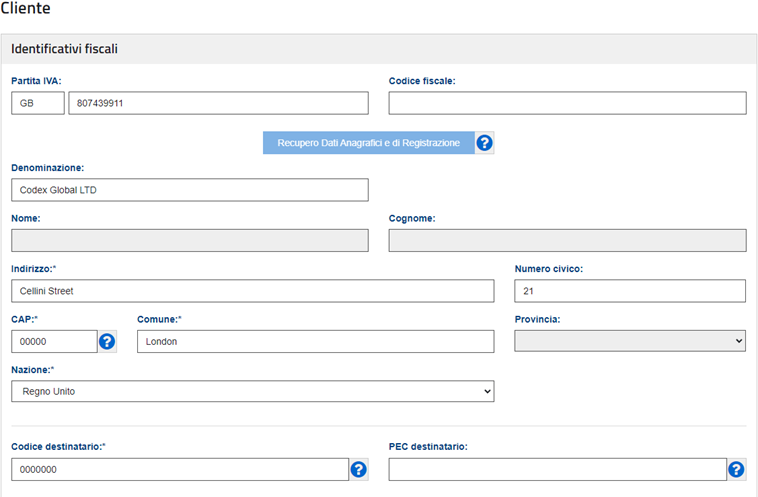

- You will be required to fill in a form with your details and your client’s details. Please refer to the screenshot below for the necessary Codex Global details:

Please note that foreign ZIP or postal code formats are not valid, so you should fill in the CAP code field with “00000” (five times zero). The “Codice destinatario” must also be filled in with the null value “0000000” (seven times zero) because this code is only available for Italian companies.

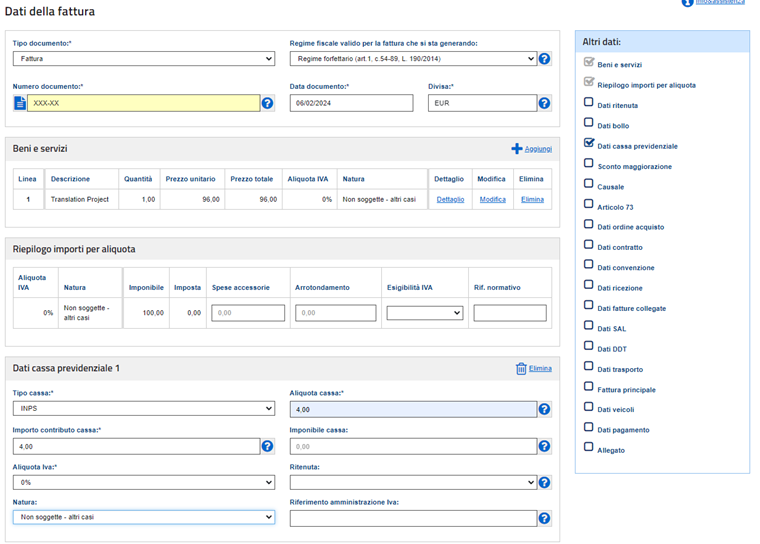

- The next section is dedicated to the items you are invoicing, so please insert the necessary details according to your services.

As you know, Codex Global does not pay for the 4% Social Security Contribution, so you should talk to an accountant or a professional to better understand how to express this in your invoice.

Our suggestion would be to extrapolate 4% of the value of your invoice and add it separately as a single amount in the section called “Dati cassa previdenziale” so that the total amount of the invoice matches your charge to Codex Global and the issued payment.

Please see the example below as a reference for a theoretical project of 100 €:

The amount of the actual translation project is reduced from 100 € to 96 €, and 4% (4 €) is added as the “Dati cassa previdenziale” amount separately so that the total amount of the invoiced project is still 100 €.

- In the following steps, the system will require you to check the details from your invoice, confirm it, seal it, and send it over to the INPS system.

Please note that Codex Global only needs you to invoice projects on our system, Plunet, and no further documentation needs to be provided.

Please find below the link to an article showing you how to submit your invoices via Plunet:

However, if you wish to share the invoice form with us, please feel free to attach the PDF invoice you can download from the INPS portal at the end of the process.

We hope these instructions will help you issue your invoices on the INPS portal correctly, but should you have any queries or require further information, please feel free to get in touch with your reference Project Manager or with our Financial Department at accounts@codexglobal.net.

Thank you for your precious support.

Codex Global LTD